The final word on the "new" exception to the open records law for "information acquired by the Department of Revenue in tax administration" — that was both enacted AND REPEALED in the 2019 legislative session — has been written.

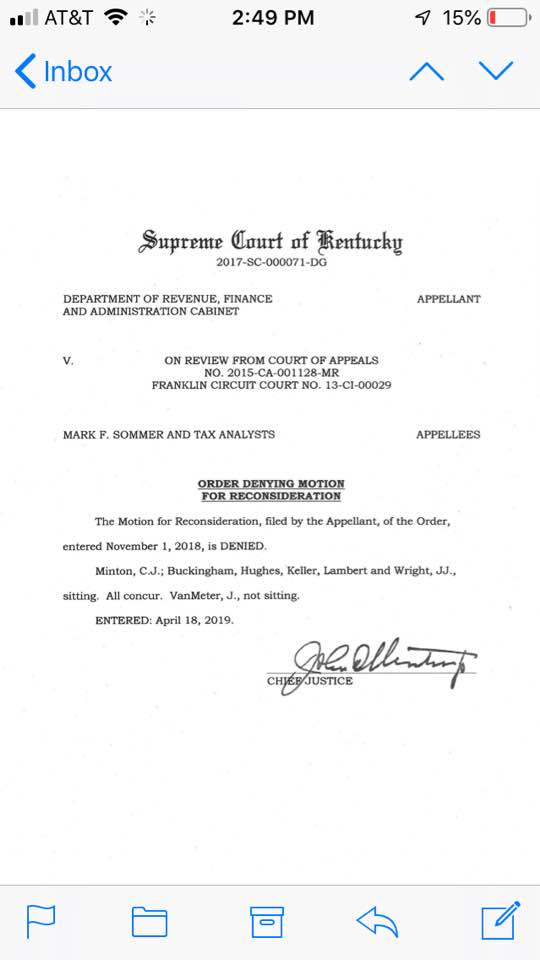

The order below confirms that the Kentucky Supreme Court today denied Revenue's request for reconsideration of the Court's November 1, 2018, opinion affirming the public's right of access to unappealed final rulings issued by Revenue in tax protests.

The 2018 opinion recognized that the rulings "can be made available without jeopardizing the privacy interests of individual taxpayers" if properly redacted. The courts declared that the rulings "contain great bodies of information related to the reasoning and analysis of the Department of Revenue with respect to its task in administration of our tax laws."

Having lost in the court in 2018, Revenue took its "case" to the legislature in 2019. Behind closed doors, and without telling lawmakers about the 2018 Supreme Court opinion, Revenue got its exception—temporarily at least.

The short-lived exception was intended to shield the final rulings, along with other agency records, from public inspection. Within days of learning that Revenue's goal was to circumvent the Court's opinion and secure a legislative "cure," lawmakers repealed the new exception.

Revenue failed to convince the court and the legislature that the challenges associated with redaction of the rulings outweighs the public's right to know how it interprets the law.

With today's order denying Revenue's request for reconsideration, we hope that the issue has finally been laid to rest in favor of open government.